Integrated energy giant Chevron Corporation (NYSE:CVX) welcomed the recent verdict of the U.S. Supreme Court. The ruling immunized Chevron from the payment of a landmark $9.5 billion fine for a pollution related case in Ecuador.

Flashback

Residents of Ecuador alleged that Texaco – subsidiary of Chevron – let out wastewater into open pits across vast swaths of Lago Agrio region. A case pertaining to the same was filed in the U.S. However, the same was dismissed and Ecuadorian plaintiffs and the American lawyer Steven Donziger had to refile the case in 2011 in Ecuador wherein Chevron was ordered to cough up $9.5 billion as a penalty.

Chevron believed that the judgment in the Ecuador court was a result of fabricated evidence and fraudulence. The company alleged that Donzigerand his associates have fabricated the writing of a key environmental report.

U.S. District Judge Kaplan in Manhattan did not implement the judgment in 2014 on grounds of bribery. The New York-based 2nd U.S. Circuit Court of Appeals upheld Kaplan's decision last year, citing "a parade of corrupt actions" by Donziger and his associates.

Present Scenario

Donziger claimed that a federal court has exceeded its authority by letting Chevron use a U.S. racketeering law to block enforcement of Ecuador's $9.5 billion award.

However, the U.S. top judges turned down the appeal by the Donziger sustaining the prior U.S. court ruling.

Former Ecuadorian judge Alberto Guerra – an important witness of Chevron – claimed that the Ecuadorian plaintiffs and Donziger had offered him bribes to announce the verdict in their favor.

Donziger views the US Supreme Court decision a “grave mistake and a sad reflection on the US judiciary in the eyes of the world.”

Donziger and Ecuadorian plaintiffs’ hope of receiving the $9.5 billion fine suffered a huge set back as Chevron has refused to pay the penalty on the back of the Supreme Court decision.

Zacks Rank and Key Picks

Headquartered in California, Chevron is one of the largest publicly traded oil and gas companies in the world, based on proved reserves. It is engaged in oil and gas exploration and production, refining and marketing of petroleum products, manufacturing of chemicals and other energy-related businesses.

The company posted a positive earnings surprise of 65.88% in the last quarter. Moreover, in the trailing four quarters it has reported average positive earnings surprise of 32.36%.

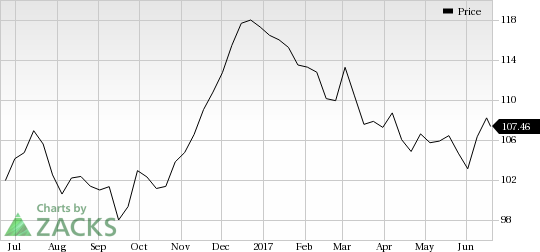

Chevron Corporation Price

The company, under the Zacks categorized Oil & Gas-International Integrated industry, currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the same industry space include Canadian Natural Resources Limited (TO:CNQ) , Enbridge Energy, L.P. (NYSE:EEP) and Delek US Holdings, Inc. (NYSE:DK) . All the three companies sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Canadian Natural Resources is expected to deliver year-over-year earnings growth of 724.76% in 2017.

Enbridge Energy reported a positive average earnings surprise of 38.22% in the trailing four quarters.

Delek US Holdings reported a positive average earnings surprise of 60.68% in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Chevron Corporation (CVX): Free Stock Analysis Report

Original post